IRS Fax Numbers

To Fax Your Tax Forms

Faxing is a secure and efficient way to send tax forms to the IRS. While you can’t file your taxes via fax, you can fax other documents related to taxes to the IRS (if you’re audited or missing documents, for example). Tax season is stressful, and the IRS requires you to submit documents by a specific deadline or incur fines. In this high-pressure, time-sensitive situation, locating the correct IRS fax numbers to send documents can be challenging.

This guide will provide a complete list of IRS fax numbers, the types of forms you can fax to the IRS and tips to help you successfully navigate tax season. No one wants to run into issues with taxes. An online fax solution is a secure way to submit tax documents and can help prevent tax filing delays.

What is an IRS Fax Number?

An IRS fax number is a designated phone number that allows you to fax documents to the Internal Revenue Service (IRS). Each IRS department or office has a unique fax number used to submit specific forms, supporting documentation and other tax-related paperwork. Due to frequent changes and multiple office locations and departments, finding the correct IRS fax number can be challenging. Check your specific forms and IRS-updated publications to ensure the accuracy of any fax number you send tax documents to.

Can You Fax Your Taxes to the IRS?

Unfortunately, you can’t file your taxes with the IRS using fax services. There are only two ways to file taxes:

- E-filing (filing taxes online)

- Mailing the documents

E-filing does not include faxing. If you’re wondering how to send tax documents to the IRS electronically, there are a few options, like tax prep software or an authorized e-file provider.

You can, however, fax other types of documents to the IRS. If you’re under an audit or an IRS agent has asked you to submit items missing from your tax return, you can fax those documents online. This is where eFax comes in handy.

Let’s explore three ways eFax can help you save time and money this tax season (and beyond).

What Tax Documents Can You Fax?

While you can’t fax tax returns to the IRS, you can fax these tax-related documents:

Form SS-4

The SS-4 form is an application for an employer identification number (EIN). Employees usually use their Social Security number when filing taxes, but if you have employees or operate a corporation, you’ll need to apply for an EIN with this form.

Form 8821

This document allows the IRS to share confidential tax information with a person or organization of your choosing. You can also use this form to revoke any previous tax information authorizations.

Form 2848

This form allows someone to represent you before the IRS. It lets you designate a power of attorney or declare a formal tax representative.

How to File Tax Forms with the IRS?

Send Tax Forms Online

Users can file forms with the IRS in several ways, including:

- Online

- Fax

- Regular postage mail

- Telephone

Next, we’ll detail the steps to file forms with the IRS using the above methods.

Send Tax Forms Online

To send tax forms using an online fax service:

Gather your tax documents:

- If you work for an employer, obtain a copy of your W-2 form. This shows your wages and taxes withheld.

- If you’re self-employed or have generated income through other means, collect your 1099 form.

- Get any other documents related to deductions or credits you plan to claim (like mortgage insurance, childcare, charitable donations, etc).

Choose an online filing method:

- Commercial tax software programs let you prepare and file your taxes online.

- IRS Free File is available for users with an adjusted gross income below a certain level.

- Direct File is an IRS pilot program that allows some taxpayers to file online directly with the IRS for free.

Create an account on your selected online tax platform and follow the prompts to enter your documents and personal information. The tax software will guide you through the process of calculating your taxes.

Double-check the information you entered, then submit your tax return electronically. Make sure you receive a tax return confirmation from the IRS.

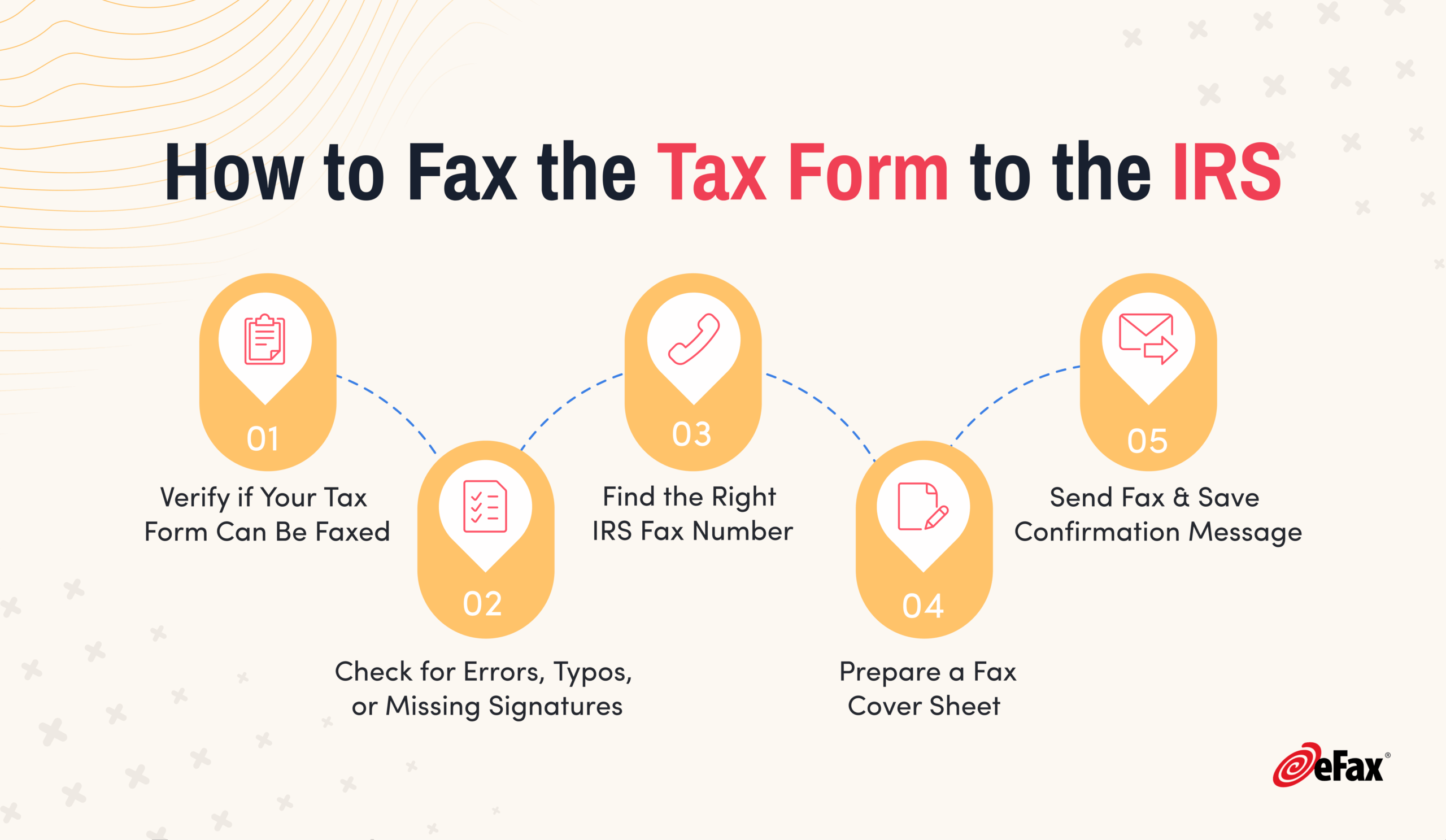

Fax Tax Forms

Remember, you can’t submit a tax return to the IRS via fax. But you can fax some documents in specific situations. To fax tax forms:

-

Determine if your tax form is eligible for faxing. See the list below for eligible tax forms.

-

Ensure the information on the form is accurate and complete. Make a copy of the form to keep for your records.

-

Identify the correct fax number for your form – the IRS uses different fax numbers for various forms.

-

Prepare your forms with a cover sheet that includes your name and contact info, the date, how many pages you’re sending and a description of the documents.

-

Send your fax using an online fax service or a traditional fax machine. Make sure you receive a fax confirmation.

Mail Tax Forms

Mailing is a less common way to submit tax documents to the IRS, but you can use it for specific situations. To mail tax forms:

-

Check the form instructions to determine if you can mail it (you can send most forms in the mail). The instructions will differ for various forms, so this step is essential.

-

Gather your tax information and ensure the forms are complete and accurate.

-

Find the correct mailing address that is specific to your form. Your form will provide the correct mailing address.

-

Select the right size envelope and include your complete return address in the upper left corner.

-

Mail your forms with sufficient postage for the weight and size of the envelope. Allow time for processing – mailed returns take much longer to process than other methods.

Send Tax Forms by Phone

You can’t file your tax return over the phone, and the IRS doesn’t offer a service allowing you to submit your tax forms over the phone. You can call the IRS for assistance with tax documents and return help.

Key Reasons Why to Fax Your Tax Forms

While filing tax forms via fax is off the table, that doesn’t mean you can’t fax those documents to other people.

Suppose you hire a tax professional to help you file your taxes this year. Perhaps they work remotely, or you don’t have time to meet in person to share all your tax documents. You can fax your documents to them to avoid any delays and help keep the professional on track.

That might not include faxing the 1040 form since the tax professional can fill that out for you. But you can still fax these documents:

- Any W-2 or 1099 forms you received

- Social Security number

- Any receipts that could help you get tax deductions (like for charitable donations or work-related purchases)

- Credit card and bank statements

- Any business financial statements for business owners

Online fax can save you time and provide a much-needed paper trail for your documents.

Common Issues When Faxing to the IRS and How to Solve Them

If you’re trying to fax to the IRS and having problems, consult this list of common issues and solutions.

Sending too many pages:

Your fax may not go through if you’re trying to send many documents. Instead, try using a digital fax service like eFax to send large files without hassle.

Line down:

Sometimes, even the IRS fax number has issues. Try sending your fax via a digital fax service that tracks your sent faxes and tells you when they’ve been received successfully.

FAQs about IRS Fax Forms & Numbers

You can electronically file tax returns and specific forms to the IRS through approved software or the Free File program. If paper filing, mail to the address in your form instructions or fax documents and forms according to IRS guidelines. When mailing, opt for certified mail with tracking to ensure that the IRS receives your documents. If you fax your documents with eFax, you should receive delivery confirmation in a few minutes.

You can also look into in-person services, which are available at limited IRS Taxpayer Assistance Centers or through certified tax professionals.

Filing by faxing tax documents to the IRS is not allowed. You can fax other documents to the IRS, specifically when under audit or at the request of an IRS agent, for missing items from your tax return.

To send a fax to the IRS, you can use an online fax service like eFax or a traditional fax machine. Obtain the IRS fax number to send documents for the IRS department or office you need to reach, attach your documents — including cover sheets or reference numbers — and follow the instructions provided by your chosen fax method.

Generally, the IRS generally doesn’t accept complete tax returns via fax. However, there are some forms and documents that the IRS either allows or requires to be submitted via fax, such as:

- Form 8962, Premium Tax Credit (PTC), is related to the Affordable Care Act and may be faxed, but only when reconciling premium tax credits. Your Letter 0012C should provide the appropriate fax number: 855-204-5020.

- Form SS-4, Application for an Employer Identification Number (EIN). W-2-employed filers usually use their Social Security Number when filing taxes, but if you have employees or operate a corporation, you’ll need to apply for an EIN with this form. If your principal business, office, or legal residence is within one of the 50 states or the District of Columbia, fax the IRS at 855-641-6935. However, if you do not have a legal residence, principal place of business, or primary office in any state, you can fax the IRS at 855-215-1627 if you are within the US, or at 304-707-9471 if you are outside the US.

- Form 8821, Tax Information Authorization, permits the IRS to share confidential tax information with a person or organization of your choosing. You can also use this form to revoke any previous tax information authorizations, and it may be faxed to the appropriate IRS department based on your location.

- Form 2848, Power of Attorney and Declaration of Representative, enables another person or entity to represent you before the IRS, and may be faxed to the appropriate IRS department based on your location.

Moreover, if you are a victim of tax-related identity theft, the IRS may require certain identity theft-related documents to be faxed for verification purposes. And in some cases, the IRS may request additional information or documentation in response to a notice, and you may be allowed to fax the required documents.

The fax number for form 8962, the Premium Tax Credit (PTC), may vary depending on the region or specific IRS office handling your case. Check the irs.gov, see your Letter 0012C instructions or contact the IRS by phone at 800-829-1040 for the accurate and up-to-date fax number.

The CP518 Business IRS Notice is a final reminder to file your prior tax returns. After completing the notice response form, it may be faxed to the IRS at 855-800-5944.

Faxing tax documents can be safer than paper faxing if proper precautions are taken. First, use secure and reputable fax services with encryption features. Then, double-check the recipient’s fax number to avoid sending sensitive information to the wrong number. Finally, confirm receipt with the IRS to ensure successful transmission.

Submit IRS Forms Instantly & Securely with eFax

With eFax, you can fax your IRS forms securely and instantly. eFax employs encrypted transmissions, gives you instant fax confirmations and offers 24/7 customer service to support you. Here are some of the reasons why eFax is a preferred choice for faxing tax documents:

Efficiency:

Easily send a fax from your mobile device or laptop with only an internet connection required.

Delivery confirmation:

You’ll get a confirmation that your fax was successfully delivered.

Security:

Faxes are encrypted with TLS, 256-bit AES encryption and SSL.

File compatibility:

eFax is compatible with multiple file types, including PDF, PNG, DOC, and more.

Blazing fast:

Only a few simple steps are between you and delivered faxes – no more waiting for physical fax machines or busy signals.