Online Fax

IRS Fax Numbers To Fax Your Tax Forms

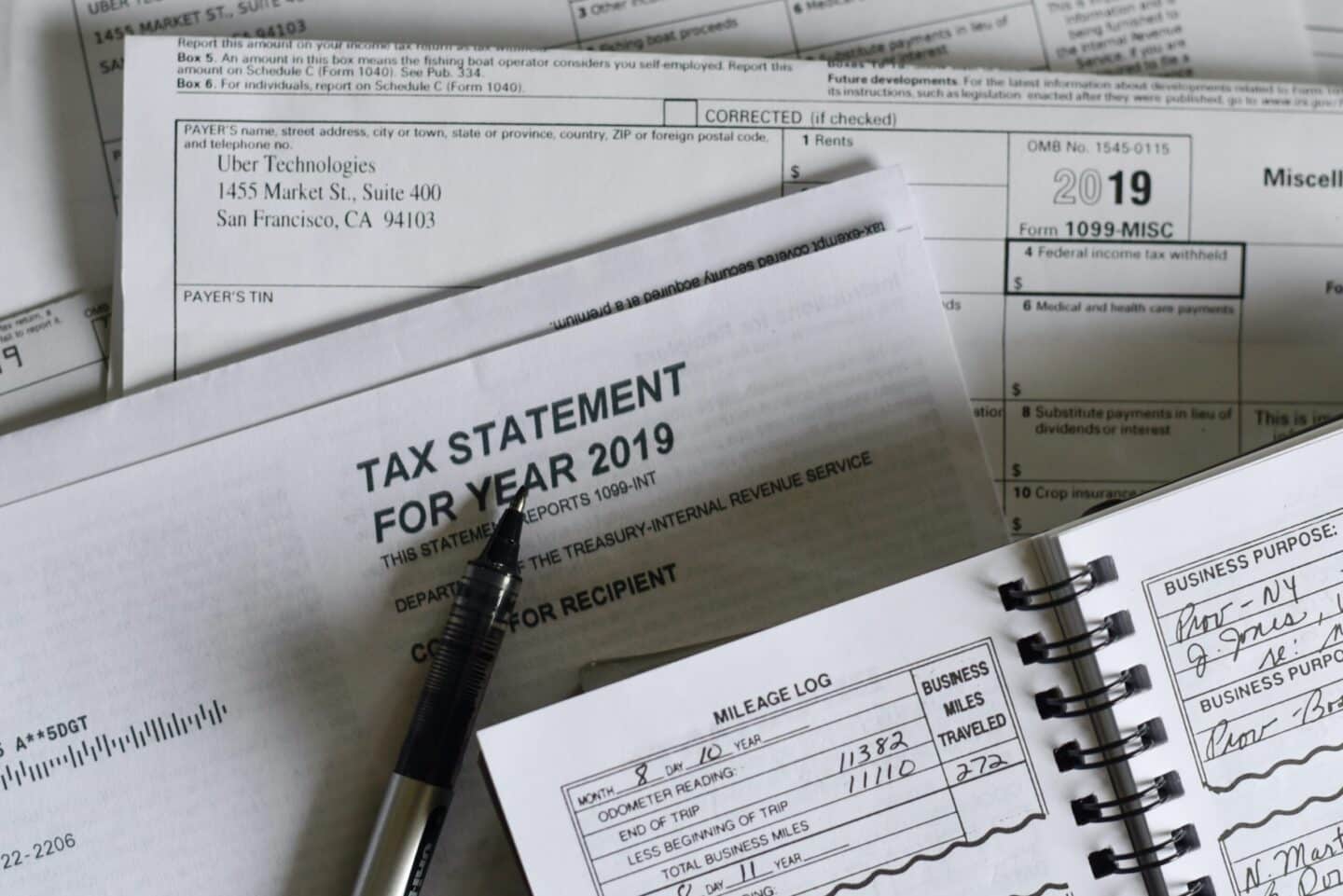

Tax season is upon us. Whether you feel prepared to file your taxes or are running behind, you probably want to file them the quickest and easiest way possible.

If mail seems too slow, you might wonder if faxing taxes is an option this year. Let’s answer that question for you, explore some in-depth details about faxing tax forms and go over IRS fax numbers.

What is an IRS Fax Number?

An IRS fax number is a designated phone number that allows you to send documents to the Internal Revenue Service (IRS) via fax. Each IRS department or office has its own fax number, which is used to submit specific forms, supporting documentation and other tax-related paperwork. Due to frequent changes and multiple office locations and departments, it can be a challenge to find the correct IRS fax number. Check your specific forms and IRS updated publications to ensure the accuracy of any fax number you send tax documents to.

Can You Fax Your Taxes to the IRS?

Let’s cut to the chase. Unfortunately, you can’t fax your tax forms to the IRS. There are only two ways to file taxes:

- e-filing

- mailing the documents

Faxing does not count as e-filing. If you’re wondering how to send documents to the IRS electronically, there are a few options, like tax prep software or an authorized e-file provider.

But again, faxing tax documents to the IRS is not allowed. You can, however, fax other documents to the IRS. If you’re under an audit, or an IRS agent has asked you to submit items missing from your tax return, then you can send them via online fax. This is where eFax comes in handy.

Let’s explore three important ways that eFax can save you this tax season (and beyond).

What Tax Documents Can You Fax?

While you can’t fax tax returns to the IRS, you can fax these tax-related documents:

- Form SS-4: The SS-4 form is an application for an employer identification number (EIN). Employees usually use their Social Security number when filing taxes, but if you have employees or operate a corporation, you’ll need to apply for an EIN with this form.

- Form 8821: This document allows the IRS to share confidential tax information with a person or organization of your choosing. You can also use this form to revoke any previous tax information authorizations.

- Form 2848: This form allows someone to represent you before the IRS. It lets you designate a power of attorney or declare a formal tax representative.

How To Send a Fax to the IRS Fax Numbers?

Wondering how to send a fax to the IRS? The good news is that it’s just like sending a fax to anyone else.

You can use a fax machine, a printer with faxing capabilities or an online fax service like eFax. The first two options require a telephone line connection and a physical device, while eFax lets you send a fax from anywhere.

Regardless of your chosen method, you still need the IRS’s fax numbers.

IRS Fax Numbers

IRS fax numbers are specific to each form and region:

IRS Form SS-4 Fax Numbers

- 855-641-6935: Anyone within the 50 states and the District of Columbia can use this fax number.

- 855-215-1627: If you don’t have a legal residence or a business address in the U.S. but are located within the States when faxing, use this number.

- 304-707-9471: If you don’t have a legal residence or a business address in the U.S. and are faxing from outside the States, use this number.

IRS Form 8821 Fax Numbers

- 855-214-7519: If you are on the eastern side of the country, use this fax number.

- 855-214-7522: This fax number works for those on the western side of the country (including Hawaii and Alaska).

- 855-772-3156: If you are within the U.S. but outside the 50 states (i.e., US Virgin Islands, Puerto Rico, Guam, etc.), use this number.

- 304-707-9785: People in foreign countries can use this fax number.

IRS Form 2848 Fax Numbers

- 855-214-7519: If you are on the eastern side of the country, use this fax number.

- 855-214-7522: This fax number works for those on the western side of the country (including Hawaii and Alaska).

- 855-772-3156: If you are within the U.S. but outside the 50 states (i.e., US Virgin Islands, Puerto Rico, Guam, etc.), use this number.

- 304-707-9785: People in foreign countries can use this fax number.

Faxing Documents During an Audit

There is another reason to fax the IRS: audits. The IRS usually completes audits in person or by mail. If they complete your audit via mail, you can fax the following:

- Completed documentation requested by the IRS

- A formal request for more time to collect said documentation

The most recent fax number available online for audit documents is 901-395-1600, but the IRS might have a new number. Make sure to use the fax number provided on the audit notice.

How To Fax a 1040 Form to the IRS

Faxing your 1040 tax form to the IRS would make things much quicker than snail mail. But unfortunately, there’s no fax number for the IRS where you can send the 1040 form.

You can use the 1040 form to file an income tax return, which qualifies as actual tax documents. And again, you can’t fax tax returns to the IRS. The only options for filing a 1040 form are snail mail and electronic filers.

Other Reasons to Fax Your Tax Forms

While filing tax forms via fax is off the table, that doesn’t means you can’t fax those documents to other people.

Suppose you hire a tax professional to help you file your taxes this year. Perhaps they work remotely, or you don’t have time to meet in person to share all your tax documents. You can fax your documents to them to avoid any delays and help keep the professional on track.

That might not include faxing the actual 1040 form since the tax professional can fill that out for you. But you can still fax these documents:

- Any W-2 or 1099 forms you received

- Social Security number

- Any receipts that could help you get tax deductions (like for charitable donations or work-related purchases)

- Credit card and bank statements

- Any business financial statements for business owners

Online fax can save you time and provide you with a much-needed paper trail for your documents.

Frequently Asked IRS Fax Questions:

How Do I Send Documents to the IRS?

You can electronically file tax returns and certain forms to the IRS through approved software or the Free File program. If paper filing, mail to the address in your form instructions or fax documents and forms according to IRS guidelines. When mailing, opt for certified mail with tracking to ensure that the IRS receives your documents. If you fax your documents with eFax, you should receive delivery confirmation in a few minutes.

You can also look into in-person services, which are available at limited IRS Taxpayer Assistance Centers or through certified tax professionals.

How Do I Send a Fax to the IRS?

Filing by faxing tax documents to the IRS is not allowed. You can fax other documents to the IRS, specifically when under audit or at the request of an IRS agent for missing items from your tax return.

To send a fax to the IRS, you can use an online fax service like eFax or a traditional fax machine. Obtain the fax number for the IRS department or office you need to reach, attach your documents — including cover sheets or reference numbers — and follow the instructions provided by your chosen fax method.

Which Documents Can You Fax to the IRS?

Generally, the IRS generally doesn’t accept complete tax returns via fax. However, there are some forms and documents that the IRS either allows or requires to be submitted via fax, such as:

- Form 8962, Premium Tax Credit (PTC), is related to the Affordable Care Act and may be faxed, but only when reconciling premium tax credits. Your Letter 0012C should provide the appropriate fax number: 855-204-5020.

- Form SS-4, Application for an Employer Identification Number (EIN). W-2-employed filers usually use their Social Security Number when filing taxes, but if you have employees or operate a corporation, you’ll need to apply for an EIN with this form. If your principal business, office, or legal residence is within one of the 50 states or the District of Columbia, fax the IRS at 855-641-6935. However, if you do not have a legal residence, principal place of business, or primary office in any state, you can fax the IRS at 855-215-1627 if you are within the US, or at 304-707-9471 if you are outside the US.

- Form 8821, Tax Information Authorization, permits the IRS to share confidential tax information with a person or organization of your choosing. You can also use this form to revoke any previous tax information authorizations, and it may be faxed to the appropriate IRS department based on your location.

- Form 2848, Power of Attorney and Declaration of Representative, enables another person or entity to represent you before the IRS, and may be faxed to the appropriate IRS department based on your location.

Moreover, if you are a victim of tax-related identity theft, the IRS may require certain identity theft-related documents to be faxed for verification purposes. And in some cases, the IRS may request additional information or documentation in response to a notice, and you may be allowed to fax the required documents.

What is the Fax Number for Form 8962?

The fax number for form 8962, the Premium Tax Credit (PTC), may vary depending on the region or specific IRS office handling your case. Check the irs.gov, see your Letter 0012C instructions or contact the IRS by phone at 800-829-1040 for the accurate and up-to-date fax number.

Can I Fax a Response to an IRS Notice?

The CP518 Business IRS Notice is a final reminder to file your prior tax returns. After completing the notice response form, it may be faxed to the IRS at 855-800-5944.

Is it Safe to Fax Tax Documents?

Faxing tax documents can be safer than paper faxing if proper precautions are taken. First, use secure and reputable fax services with encryption features. Then, double-check the recipient’s fax number to avoid sending sensitive information to the wrong number. Finally, confirm receipt with the IRS to ensure successful transmission.

Make Faxing Easier With eFax

eFax makes faxing documents quicker, easier and safer. When you sign up with eFax, you can choose your dedicated fax number or port an existing one — no need for an actual telephone line. Then, you can use that number to fax via email, eFax’s mobile fax app, eFax messenger or your eFax MyPortal.

eFax offers a way to send faxes whether at your work computer, at home on your laptop or using your phone. The best part is that eFax keeps your data safe. It encrypts the documents while in transit, protecting them from hackers. So when faxing sensitive data — like tax information — you can trust eFax to keep your data safe.

So, what are you waiting for? Sign up for eFax and protect the security of your tax forms!